It always happens. . . We discover an “issue” in one of my practices and like clockwork it starts popping up everywhere. Even if you are not currently experiencing this issue in your practice, please read this e-blast and share the information with staff members who enter demographic and insurance information, check eligibility and benefits or are part of the claims submission, re-submission and appeals process. Actually, scratch that. . . Please share it with EVERYONE on your TEAM.

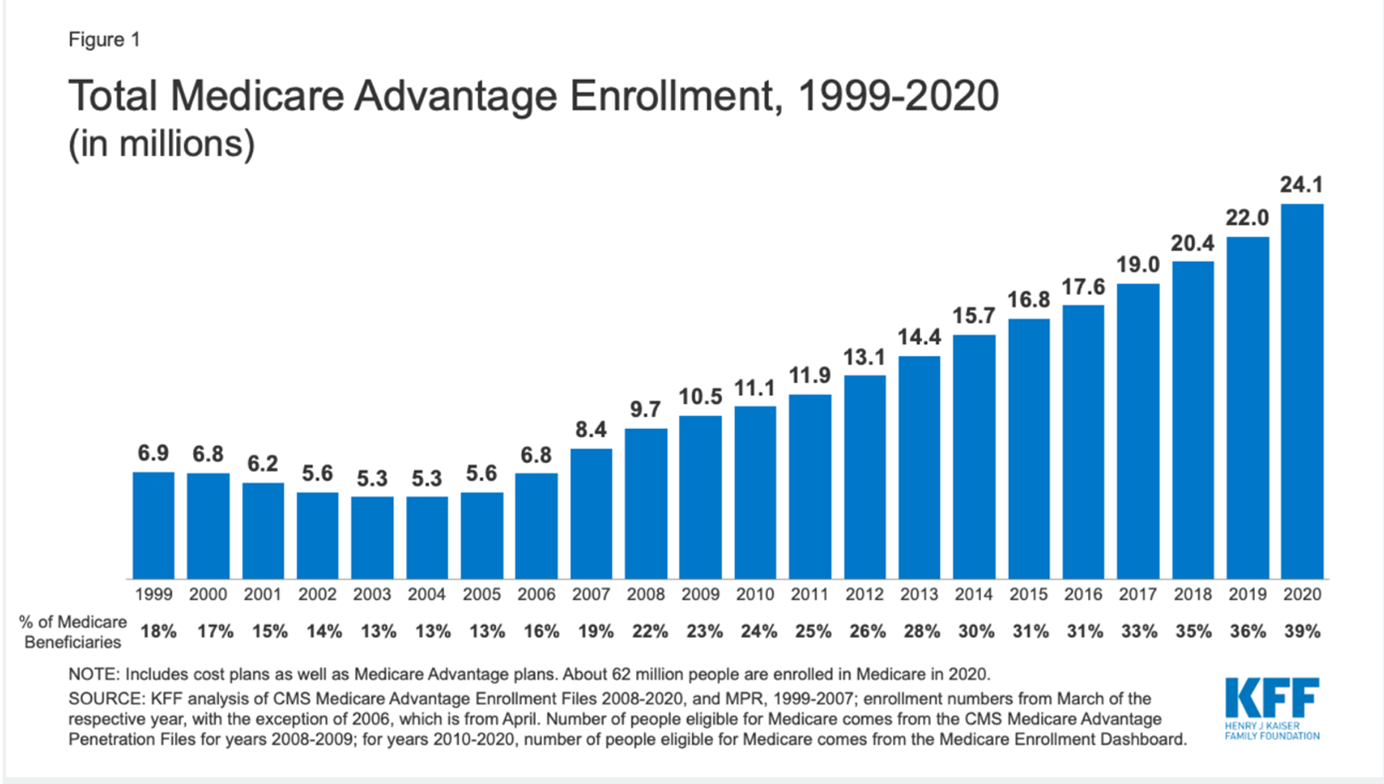

Here’s a fun fact that is wreaking havoc in practices with a large volume of patients over 65, especially where facility work (SNFs, assisted living, nursing homes) is involved: Enrollment in Medicare Advantage Plans has DOUBLED over the past decade

It has been reported so far in 2021 that approximately 43% (up from 39% in 2020; see graph below) of the 63 million individuals who “have Medicare” actually receive their benefits via an Advantage Plan. And just when you thought you were finished updating patient insurance information in January and February, if those Medicare Advantage patients decide that the plan they chose was not the right fit and they want to go back to traditional Medicare, they have until March 31st to do so.

Why is this information so important to your practice? Let me tell you. . .

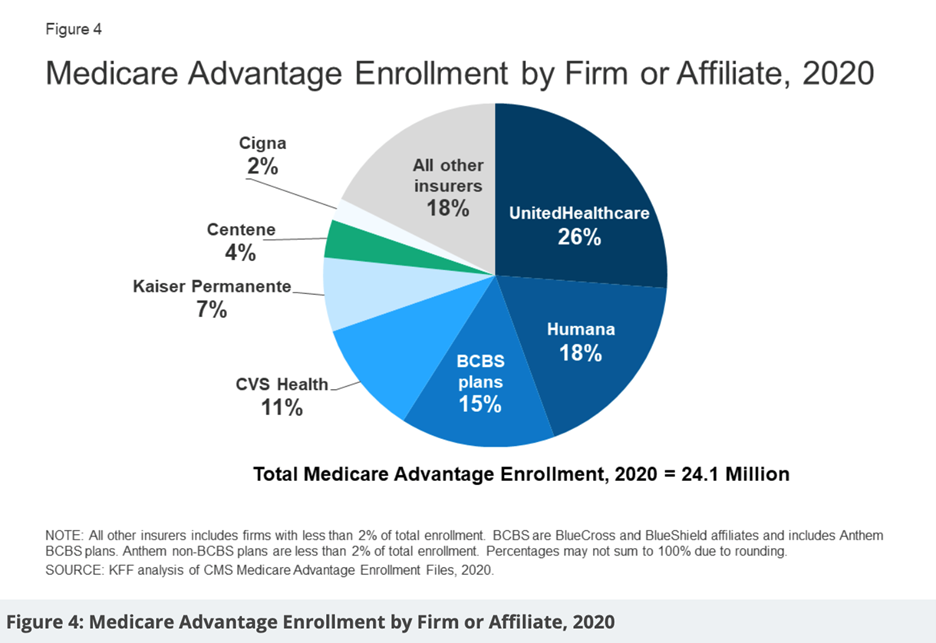

When a patient who is over 65 calls the office to make an appointment (for the purpose of this article we are only discussing “Medicare age” patients, not those with disabilities or end-stage renal disease) they are asked what type of insurance they have. This is usually followed by an answer that sounds something like “Medicare and Blue Cross” or “Humana and Medicare, or maybe a list of three.

This patient should then be asked if their insurance (other than Medicare) is a supplement or replacement plan (to which there may or may not be a clear or correct answer).

In any case, it is imperative that the staff member who is scheduling the appointment collects the insurance ID #s (making sure that the Medicare # is current and not a social security number followed by a letter; it has been 3 years now since Medicare IDs were updated and I still see lots of kicked back claims because the old number is still being used). The staff member should then use these ID #s to do some investigating. First, if the policy or policies are active. All of the integrated EHR/ PM systems have auto eligibility functions which will clearly show us if the plan is active (green circle) or if there is an issue (yellow or red circle). WHEN YOU SEE A GREEN CIRCLE NEXT TO A MEDICARE POLICY, YOU CANNOT STOP THERE!

If the patient is at least 65, they have a “Red, White and Blue” Card (traditional Medicare; with part A coverage for hospital/inpatient services and B for outpatient services) so the system will automatically show ACTIVE COVERAGE. You MUST THEN either click through to the details of the patient’s benefits or login to the Medicare provider website to see if they have traditional Medicare or an Advantage Plan. It will clearly state if the patient has an alternative plan that should be billed for services.

In these cases (for the 43% of the patients that have selected an Advantage Plan; whether they understand how it works or not), Medicare should NOT be listed as their primary or secondary insurance within the EHR/PM software (instead, the Medicare ID# should be recorded as an easily accessible document in the patient’s electronic chart).

To take it a step further, when patients are treated in outside facilities, there is often a reliance on facility administrative staff to provide patient information. In these cases, it is IMPERATIVE to verify coverage ahead of time and determine “who gets the bill” or if a patient is enrolled in a plan that you are not contracted with. In facility cases we also need to know where to send statements (not to the patient in the skilled nursing facility but rather to a responsible family member or power of attorney).

What I am seeing in practices everywhere is a lack of investigation (or a lack of understanding/training of how to investigate) prior to treating to determine the above listed details, causing rejections or claims sitting in “User Hold” unable to be submitted until insurance information is updated, PCP is recorded, and Date Last Seen (DLS) by PCP (not by you) is entered in the appropriate “Box” (so that it is included on the claim). It is not enough to record DLS in the encounter and with some systems, this information has to be entered prior to starting/opening the encounter in order for it to attach to the claim (this is a nuance that should be discussed with your biller or RCM company if it is causing delays in submission or rejections). Train your “Medicare age” patients at check-in to name their PCP (don’t just assume it’s the same as the previous visit) and to provide the date when they last saw him/her.

Please note: Just as with traditional Medicare plans, when submitting for routine foot care with class findings, Medicare Advantage plans also require that DLS by PCP is within 6 months. Some of these plans will also require referrals or prior-authorizations (HMOs) but not all, so it is important to communicate with your biller or RCM company frequently as patients present with new or modified plans.

Verify coverage of all patients prior to every visit and make sure you have a copy or scan of the FRONT AND BACK of all cards in the patient’s chart.

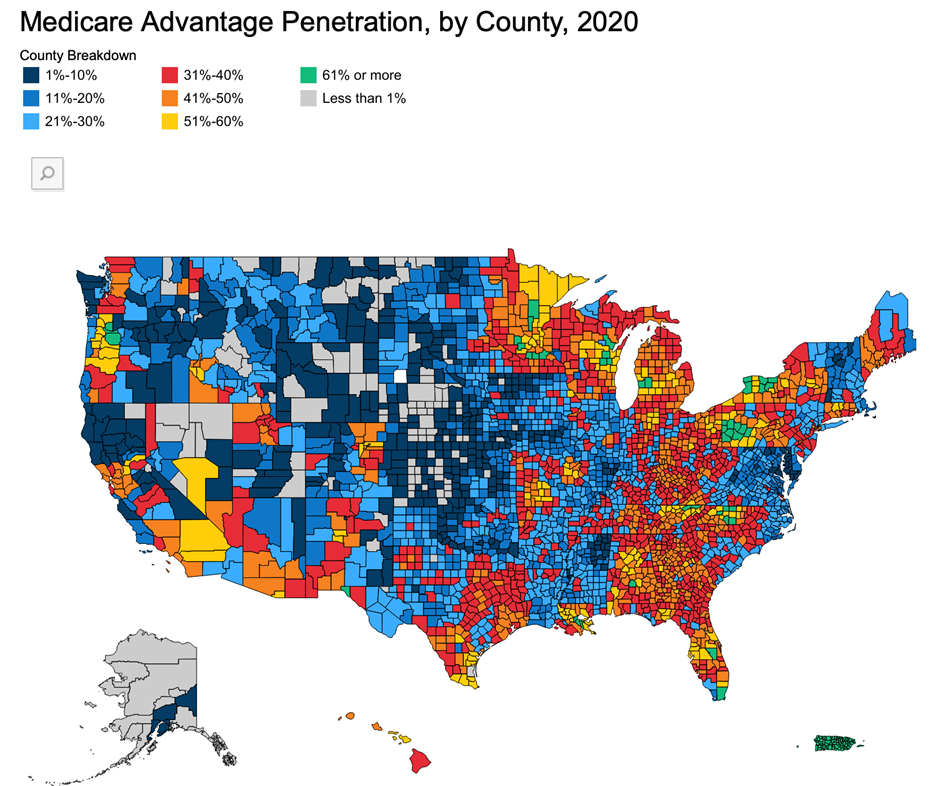

Listed below is additional information that I found very interesting as provided in a January 2021 article published by the Henry J Kaiser Family Foundation “A Dozen Facts about Medicare Advantage Plans” (click the link below).

Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B not to exceed $6,700 (in-network) or $10,000 (in-network and out-of-network combined). In 2021, these limits increased to $7,550 (in-network) and $11,300 (in-network and out-of-network).

To read the full article, click here:

https://www.kff.org/medicare/issue-brief/a-dozen-facts-about-medicare-advantage-in-2020/

About Cindy Pezza

Pinnacle Practice Achievement (PPA) is a consulting firm dedicated to coaching podiatrists and their teams nationwide. For nearly two decades, President, CEO, and lead consultant, Cindy Pezza, PMAC has immersed herself in the rapidly changing landscape of podiatric practices as well as the need to continuously evolve the methods in which they are managed. She has dedicated much of her life to traveling and educating podiatry students, residents, active providers and their staff members on the importance of establishing protocols and systems in order to achieve success. In working with Pinnacle Practice Achievement (PPA) providers are able to utilize Cindy’s expertise and select a program that works best to fit their individual needs. From one-on-one custom consulting to convenient and cost-effective monthly subscription programs including access to a vast and expanding library of resources, monthly interactive webinars and exclusive vendor discounts, PPA offers what practices require the most to survive and thrive in the ever-changing world of specialty healthcare.

One of the most cost-effective ways to work with Pinnacle Practice Achievement is through membership to the Practice Engagement Program (PEP) which includes:

Twice monthly interactive webinars with topics geared specifically towards the challenges faced by podiatrists every day, Unlimited access to an extensive and ever-expanding resource library including compliance documentation, billing and coding tips, treatment protocol examples, office policies and procedure guides, human resources related materials (from hiring through firing), marketing resources, HIPAA and OSHA references, as well as staff training videos, lessons and quizzes, Preferred pricing and exclusive discounts on commonly utilized products, services and liability coverage from hundreds of vendors dedicated to our profession, Opportunities to save on CEUs (both live and virtually) through Cindy's extensive network of podiatric organizations and nationally recognized experts, Reduced pricing for one-on-one practice consulting and coaching

For more information and to join today visit: https://pinnaclepa.com/practice-engagement-program-pep/

Read Comments